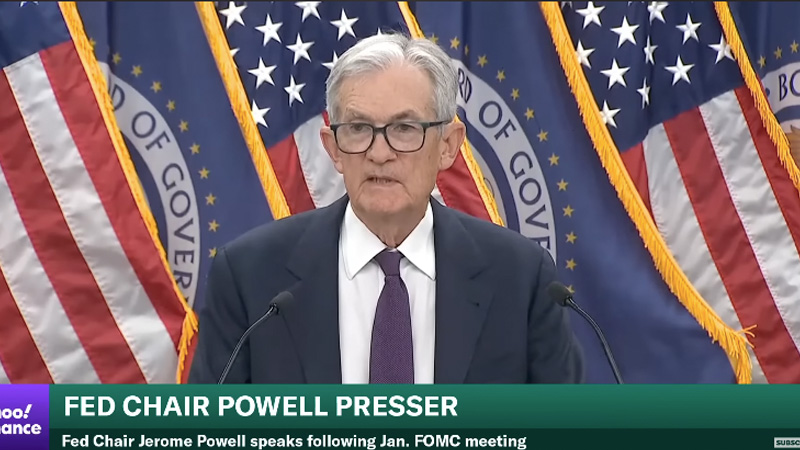

Image Credit: youtube screenshot

Image Credit: youtube screenshot During a press conference Wednesday, Federal Reserve Chairman Jerome Powell raised eyebrows when he said he would not comment on the collapse of the U.S. dollar, otherwise known as a “Federal Reserve note,” which has plunged to its weakest level since 2022.

Powell spoke to reporters following a Federal Open Market Committee meeting, where the decision was made to hold interest rates steady, rather than raise or lower them, as President Donald Trump has been requesting.

Assuming Powell may be worried about the dollar’s rapid devaluation, one reporter asked, “What do you think is driving the US currency lower and have you been at all concerned just by the extent of the volatility we’ve seen this week?”

Powell, however, despite his role as Fed chair, did not offer an opinion on the topic.

“So…as you probably know… we don’t comment on the dollar. Really the administration, especially the Treasury Department, has the job of oversight over the currency and so on and exchange rates and all that. We don’t comment on that. It’s not our not our role. So I have nothing for you,” he said.

Jerome Powell on the US dollar 💵. pic.twitter.com/FsdoVE1Zw2

— Interplanetary Dogecoin Advisor (@johncarter6016) January 28, 2026

Unsatisfied with the response, the reporter probed further, asking, “I mean, what’s your view on the market movements? I mean, what do you think is behind them? Is it asset managers diversifying? Is it?”

Again, Powell shut her down, insisting, “Yeah, I just don’t… you know, we don’t we don’t talk about the dollar. We don’t talk about what moves it around. It’s just, it’s just not appropriate for us to do. So really the Treasury Department has that it’s their their role, their bailiwick and we stay off it. We do monetary policy and some other things, but we don’t we don’t comment on the dollar.”

Weird, because the last time we checked every single physical U.S. dollar states that it is a “Federal Reserve note,” and he’s the chairman of the Federal Reserve; however, it’s apparently a long-standing rule for Fed chairs to abstain from commenting on the dollar’s strength.

On the other hand, Powell had plenty to say about the skyrocketing value of precious metals like silver and gold, telling reporters not to read too much into it.

“As I’m sure you’ve noticed, gold and silver prices have experienced historic gains of late,” a reporter told Powell. “I’m wondering how much attention, if any, you pay to those moves and and what message you may take from these uh significant price increases we’ve seen for precious metals.”

Unsurprisingly, the Fed chair dismissed rising silver and gold prices as unimportant.

“Don’t take much message macroeconomically,” Powell responded. “Um, the argument can be made it’s, you know, that we’re losing credibility or something. It’s simply not the case. If you look, if you look at where inflation expectations are, our credibility is right where it needs to be. So we look at those things. We don’t we don’t get spun up over particular asset price changes, although we do we do monitor them of course.”

Powell says, gold rally means nothing

— Cloud9 Markets (@cloud9markets) January 29, 2026

This guy is a complete idiot!

He is the main culprit in destroying US DOLLAR and people’s savings

Now he says don’t worry about it 👇

pic.twitter.com/jtnwTWdiGy

If gold is so unimportant, why are central banks in several countries, including China, Poland, Kazakhstan and others, buying tons of the precious metal, helping drive prices to all-time highs?

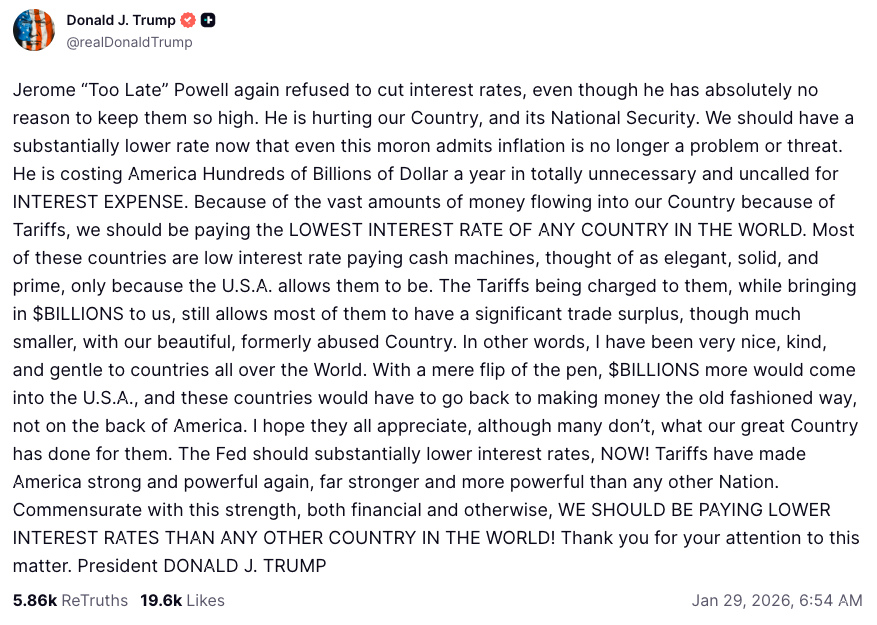

Meanwhile, President Trump on Thursday chastised “Too Late” Powell for refusing to lower interest rates.

Watch the full presser:

Economist Peter Schiff discussed Powell’s remarks in his Wednesday podcast:

Visit TheAlexJonesStore.com and pick up Ultra Methylene Blue TINCTURE, or CAPSULES, the synergistic Ultra Methylene RED, Ultimate Seamoss Gummies With Bladderwrack & Burdock Root, or the Shilajit Complex – Super-Infused Supplement!