Image Credit: Samuel Corum / Stringer / Getty

Image Credit: Samuel Corum / Stringer / Getty Update 1730EST: Tesla shareholders approved a massive new compensation package for Elon Musk, potentially worth up to $1 trillion, with more than 75% voting in favor at the company’s Austin annual meeting.

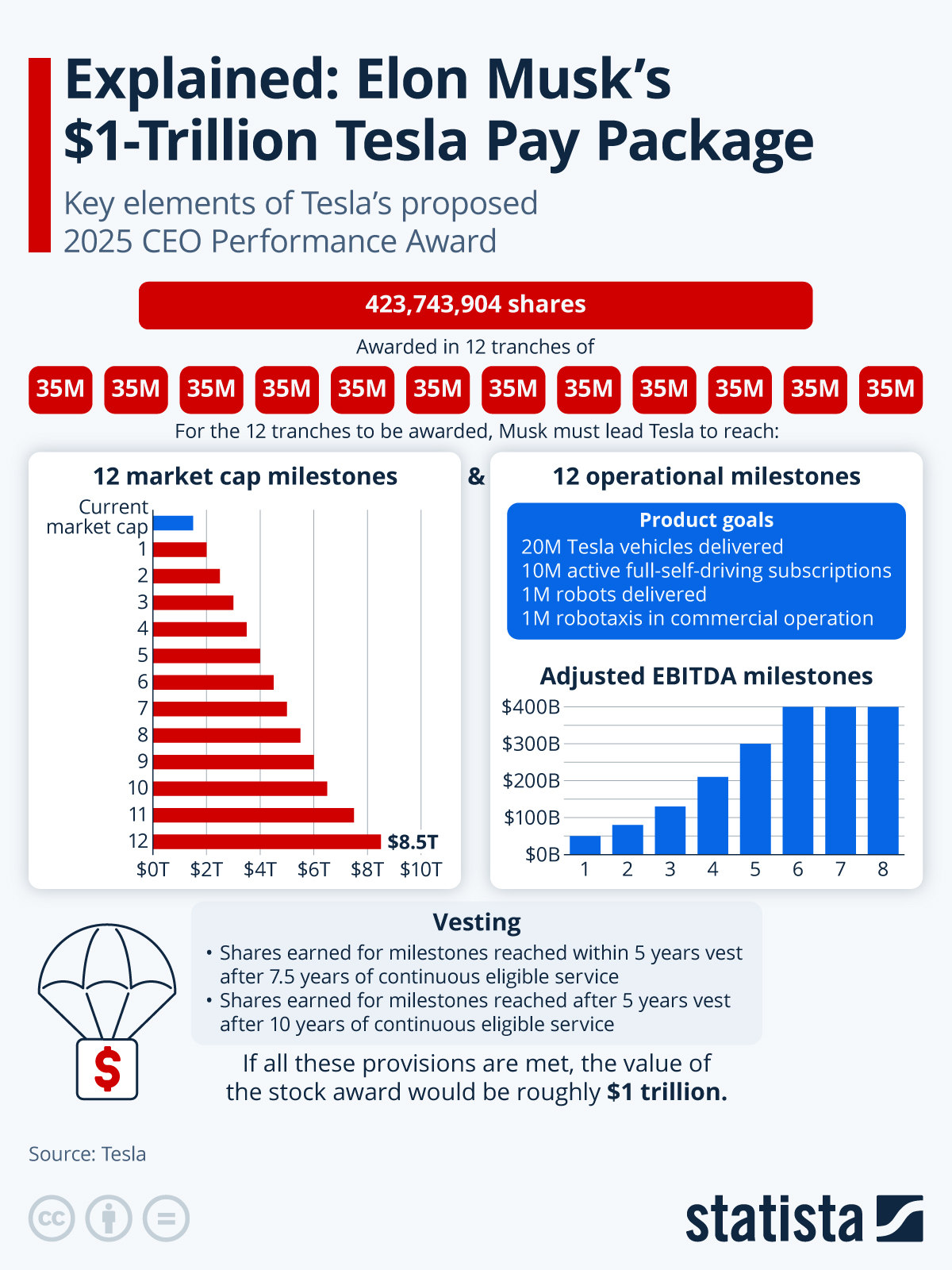

However, as noted earlier, the full compensation would only be delivered if Musk vaults the company from its present value of $1.1 trillion to $8.5 trillion, a figure that exceeds the current combined market values of Meta, Microsoft and Google-parent Alphabet, the filing says.

The compensation package also includes a set of production goals, including one million Robotaxis in commercial operation and the delivery of one million humanoid robots over the next 10 years, according to the securities filing.

The decision, celebrated by Musk onstage alongside Tesla’s humanoid robots, signals support for his vision to expand beyond electric vehicles into AI and robotics. The vote followed intense debate, with major investors and proxy advisers like CalPERS, Norges Bank, ISS, and Glass Lewis opposing the plan as excessively large, while others, including Charles Schwab, argued it keeps Musk aligned with shareholders.

“We are at a pivotal juncture in Tesla’s history, and the proposals the Special Committee has carefully designed and the Board has put forward will help determine Tesla’s future,” the company’s website said earlier this week. “If you believe, like us, that Elon is the CEO that can make our ambitious vision a reality, vote NOW.”

Not everyone was convinced: before Tesla released the results of the shareholder vote, some major shareholders said they had voted down the proposal. Norway’s $2 trillion sovereign wealth fund said Tuesday that it had voted against the pay package, raising concerns about its scale and potential risks.

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk consistent with our views on executive compensation,” Norges Bank Investment Management, the manager of the fund, said in a statement.

Musk, already Tesla’s biggest shareholder at roughly 15%, had suggested he might leave if he didn’t secure a sufficiently large stake, even as his earlier pay award remains under legal review. Last year, a Delaware judge twice struck down a $50 billion pay package for Musk put forward by the company in 2018.

The pay package could also increase Musk’s ownership stake in Tesla to as much as 29%. Musk has long pursued a larger ownership stake.

Tesla’s CEO, considered the world’s richest person, currently boasts a net worth of about $504 billion, according to Forbes. If he were to receive the full pay package, Musk would become the world’s first-ever trillionaire.

Original article:

Elon Musk’s staggering $1 trillion pay package will dominate Tesla’s annual shareholder meeting today, setting up one of the most high-stakes corporate votes in years over the future of the world’s most visible CEO.

The board has made the choice explicit. Tesla Chair Robyn Denholm warned that the decision is about whether shareholders still want to “retain Elon as Tesla’s CEO and motivate him” to make the company “the leading provider of autonomous solutions and the most valuable company” on Earth.

After a Delaware judge struck down his previous $56 billion award twice, Musk has gone without any official compensation — and Tesla is now asking investors to restore a deal even larger than before.

The plan ties Musk’s payout to wildly ambitious milestones.

The package is structured in 12 tranches, each worth 35.3 million shares, tied to both market capitalization milestones and operational objectives.

The first market cap target is $2 trillion, and the final milestone is $8.5 trillion.

Operational targets include:

- Delivering 20 million vehicles over 10 years, more than double Tesla’s production over the past dozen years.

- Securing 10 million full self-driving subscriptions.

- Producing 1 million humanoid robots through Tesla’s Optimus division.

- Operating 1 million robotaxis in commercial service.

- Meeting earnings milestones in eight consecutive quarters, each measured over four quarters.

While these goals are technically achievable, Tesla has struggled to meet some recent operational benchmarks.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

As BI noted Musk himself framed the stakes differently on the latest earnings call: “I just don’t feel comfortable building a robot army here and then being ousted because of some asinine recommendations.”

Proxy advisers ISS and Glass Lewis are urging a no vote, citing “excessive power” and weak oversight. Musk fired back in recent days, calling them “corporate terrorists.” But with his own roughly 13% stake and a large base of loyal retail shareholders who usually back him, supporters say the numbers are in his favor. As billionaire investor Ron Baron told CNBC, “Elon is the ultimate ‘key man’ of key man risk. Without his relentless drive and uncompromising standards, there would be no Tesla.”

Norway’s $2 trillion sovereign wealth fund said it would vote no because of “the total size of the award, dilution, and lack of mitigation of key person risk.” Corporate governance expert Nell Minow said she’d only consider the package if Musk “shut up about politics” and focused fully on Tesla instead of juggling xAI, SpaceX, Neuralink, The Boring Company and his political campaigns.

Shareholders will also weigh Musk’s push for Tesla to invest in his AI startup xAI, which he says Tesla “would have invested in… long ago” if it were up to him.

Meanwhile, broader concerns over governance are on the ballot — though Tesla’s board has recommended against all shareholder accountability measures, including annual director elections and reversing a Texas rule that limits which investors can sue the board. “These actions violate basic tenets of good corporate governance and must be reversed,” said New York State Comptroller Thomas P. DiNapoli.

All of this comes during a volatile year for Tesla. The company appears at a jumping off point into AI and robotics, while research suggests the company could have sold dramatically more cars without Musk’s actions outside the company. Yet shares have rebounded — up 14% this year — boosted in part by Musk’s own $1 billion stock purchase.

The outcome of the vote is expected to be announced after today’s meeting in Austin. You can watch the full meeting below, beginning at 4PM EST: