Image Credit: Alex Wong / Staff / Getty

Image Credit: Alex Wong / Staff / Getty On Friday night President Donald Trump addressed the affordability crisis that’s strangling younger Americans. The President announced that he was able to get mortgage rates down to 5.7% and that he will be capping credit card interest rates to 10% for one year.

Under President Joe Biden’s autopen administration credit card companies began charging interest rates of “20 to 30%, and even more” while mortgage rates climbed to around 8%, according to Trump.

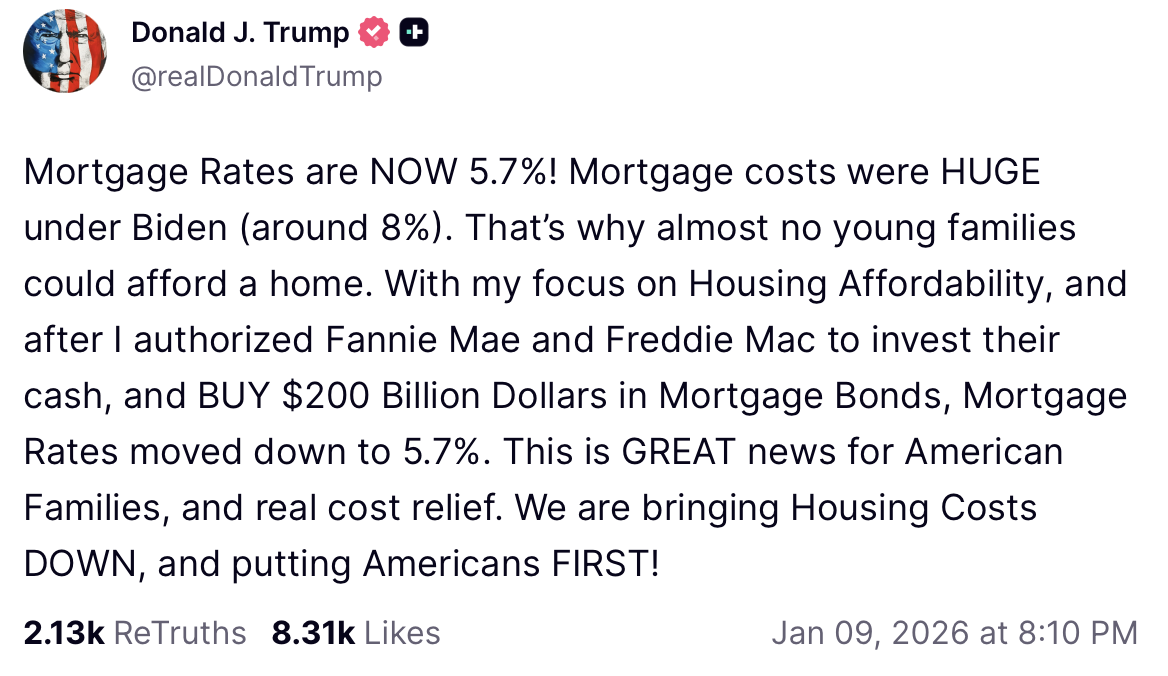

Mortgage Rates are NOW 5.7%! Mortgage costs were HUGE under Biden (around 8%). That’s why almost no young families could afford a home. With my focus on Housing Affordability, and after I authorized Fannie Mae and Freddie Mac to invest their cash, and BUY $200 Billion Dollars in Mortgage Bonds, Mortgage Rates moved down to 5.7%. This is GREAT news for American Families, and real cost relief. We are bringing Housing Costs DOWN, and putting Americans FIRST!

Please be informed that we will no longer let the American Public be “ripped off” by Credit Card Companies that are charging Interest Rates of 20 to 30%, and even more, which festered unimpeded during the Sleepy Joe Biden Administration. AFFORDABILITY! Effective January 20, 2026, I, as President of the United States, am calling for a one year cap on Credit Card Interest Rates of 10%. Coincidentally, the January 20th date will coincide with the one year anniversary of the historic and very successful Trump Administration. Thank you for your attention to this matter. MAKE AMERICA GREAT AGAIN! PRESIDENT DONALD J. TRUMP

The move is the latest in a new push by the administration to address affordability.

On Wednesday President Donald Trump addressed the un-affordability of home ownership in America by pledging to ban large institutional investors from buying up single-family homes.

Infowars covered how Trump faced a massive backlash in November for focusing on unpopular agendas rather than the affordability crisis facing his constituents. He then dug his hole deeper by saying affordability was a Democrat lie.

Top pollster Mark Mitchell explained how the affordability crisis and bad messaging is destroying Trump and the Republicans in the polls. He then met with Trump and the administration where he explained these issues to them. It now appears his advice has been acted upon.

While interest rates rose to over 18% in the early 1980s, home prices were extremely low, allowing homebuyers to pay off their mortgage quickly and avoid decades of interest payments.

Credit card debt skyrocketed in the last few decades. LendingTree described this rise in an article Friday (note that charts of this debt over the years can be viewed in their article)

Card debt showed hockey-stick growth until the financial collapse in 2008, when balances fell from $866 billion in Q4 2008 to $660 billion in Q1 2013. But, as you can see in the chart below, the hockey stick returned.

Then, when the pandemic took hold in 2020, credit card balances plunged again — from $927 billion in Q4 2019 to $770 billion in Q1 2021. But — again — the hockey stick returned, thanks to a massive spike in Q4 2021.

YouTuber Zac Rios specializes in chronicling the affordability crisis that has gripped the nation. One of his most popular videos covers the cost of living crisis in 2025.

While the cost of living crisis is an external factor affecting Americans, another crisis that is much more self-inflicted is the topic that YouTuber Caleb Hammer spotlights in his Financial Audit series – bad financial habits.

His most viewed video features a “27-year-old with more debt than anyone should ever have.” While this would be an extreme example, lower interest rates on credit cards can help millions of Americans with much more reasonable borrowing habits.

Thought leader Wade Stotts of The Wade Show With Wade covered what’s become reality for tens of millions of Americans:

Talkshow host Patrick Bet-David recently discussed the un-affordability of homes due to the steep interest rates on top of already high prices.

Since Trump Was Elected Alex Jones Has Warned Of Deportation Escalation Events